For consultant functions.

| Photograph Credit score: iStockphoto

The monetary dating between the Union executive and the States in Bharat is asymmetrical, as in lots of alternative international locations with a federal constitutional framework. Because the fifteenth Finance Fee famous, States incur 61% of the income expenditure however bind most effective 38% of the income receipts. In scale down, the power of the States to incur expenditures depends on transfers from the Union executive. In consequence, there may be the disease of Vertical Fiscal Imbalance (VFI) in Indian fiscal federalism the place expenditure decentralisation overwhelms the income elevating powers of the States.

Why must VFI be lowered?

Constitutionally, the monetary tasks of the Union executive and the States are divided. At the income entrance, to maximize the potency of tax assortment, the Non-public Source of revenue Tax, the Company Tax and part of oblique taxes are easiest accumulated by means of the Union executive. However at the expenditure entrance, to maximize the potency of spending, publicly equipped items and products and services are easiest provided by means of the tier of the federal government closest to its customers. It’s on this context that the level of VFI deserves consideration.

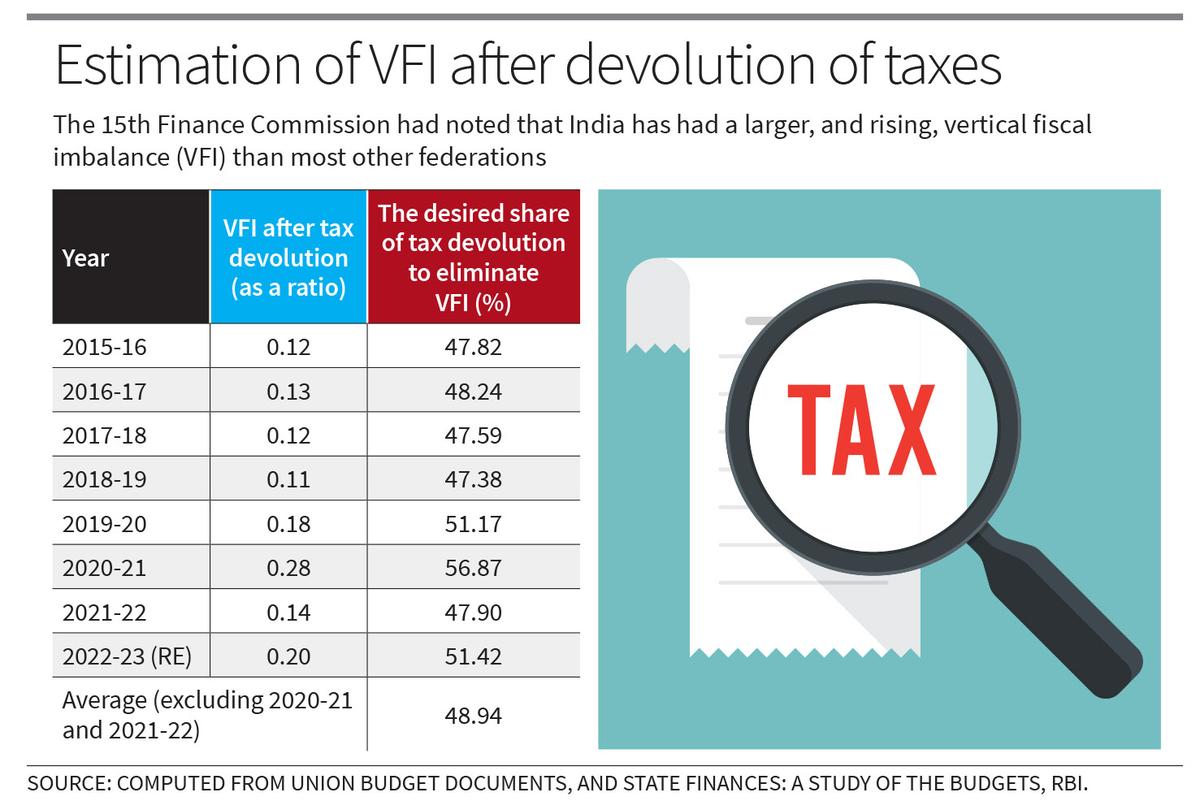

The fifteenth Finance Fee had famous that Bharat has had a bigger, and emerging, vertical imbalance than maximum alternative federations. Those imbalances have been additional magnified all the way through classes of crises, such because the COVID-19 pandemic, which drove a immense wedge between one’s personal revenues and expenditure obligations on the sub-national stage.

The disease of VFI falls below the purview of the Finance Fee, and it offer with extensively two questions. The primary query is the best way to distribute the taxes accumulated by means of the Union executive to the States as an entire. Those transfers are made as a prescribed percentage of the “Net Proceeds” (Improper Tax Income of the Union much less surcharges, cesses and prices of assortment). The second one query is the best way to distribute taxes throughout States. The topic of VFI arises as a part of the primary query.

With the exception of devolving taxes, the Finance Commissions additionally suggest grants to States short of support below Article 275 of the Charter. However those are normally for scale down classes and for explicit functions. There also are transfers to the States that fall outdoor the Finance Fee’s ambit. As an example, the Union executive spends considerable quantities — below Article 282 of the Charter — on boxes falling within the Order and Concurrent lists thru centrally backed schemes and central sector schemes. However such grants are tie transfers that come with conditionalities. In sum, the devolution of taxes from the online proceeds is the one switch to the States this is untied or unconditional.

Calculating VFI in Bharat

Right here we attempt to estimate the VFI in Bharat then the devolution of taxes to the States. We measure VFI on the stage of “all States”, and no longer one at a time for every Order. For this, we usefulness a globally approved form. We first estimate a ratio the place the numerator is the sum of the Personal Income Receipts (ORR) and the tax devolution from the Union executive for all States. The denominator is the Personal Income Expenditure (ORE) for all States. If this ratio is not up to 1, it means that the sum of personal income receipts and tax devolution of the States is insufficient to fulfill the ORE of the States. If we subtract this ratio from 1, we get the shortage in receipts. It’s this shortage that we usefulness as a proxy for VFI then devolution.

We will nearest ask the easy query: how a lot must tax devolution be on one?s feet over and above that beneficial by means of the time Finance Commissions to equalise the ratio to at least one? Equating the ratio to at least one would do away with VFI. Within the connected desk, we display that the common percentage of web proceeds devolved to the States between 2015-16 and 2022-23 must had been 48.94% to do away with the VFI. However the stocks of tax devolution beneficial by means of the 14th and fifteenth Finance Commissions have been most effective 42% and 41%, respectively, of the online proceeds.

Elevating tax devolution

Many States have raised the call for that the percentage of tax devolution from the online proceeds will have to be mounted at 50% by means of the sixteenth Finance Fee. They upload pressure to this call for by means of pointing to the exclusion from the online proceeds of the considerable quantities of cesses and surcharges, which truncates the online proceeds throughout the improper tax income.

Our research on this article lends empirical assistance to this call for. Right here, we’ve got assumed the existing ranges of expenditures of the States as a given. On the combination stage, those in truth incurred expenditures have no longer most effective conformed to but in addition underutilised the borrowing limits specified within the fiscal accountability legalisations. Even nearest, we discover that the percentage of web proceeds devolved to the States will have to be on one?s feet to about 49% to do away with VFI. Such an building up in devolution would playground extra untied assets within the fingers of the States to spend on their voters. It could additionally safeguard that States’ expenditures higher reply to jurisdictional wishes and priorities, and that the potency of expenditures is enhanced. Total, it is going to be a exit against a wholesome device of cooperative fiscal federalism.

R. Mohan is former Indian Income Carrier officer. R. Ramakumar is Schoolmaster, Tata Institute of Social Sciences, Mumbai.

Revealed – September 06, 2024 08:30 am IST