Cambria Funding Control founder and CIO Meb Faber weighs in on how buyers can place their portfolio and discusses a unutilized tax-aware ETF on ‘Making Cash.’

The most efficient 3 appearing exchange-traded finances of 2024 have something in ordinary: each and every is related to AI super-stock Nvidia.

T-Rex 2X Lengthy NVIDIA Day-to-day Goal ETF and GraniteShares 2x Lengthy NVDA Day-to-day ETF have complex greater than 400% each and every, day Direxion Day-to-day NVDA Bull 2X Stocks is up over 350%, in step with VettaFi.

Highest 3 Acting ETFs of 2024 Connected to Nvidia (VettaFi )

“NVDX, NVDL, and NVDU are 2x leveraged long bets on Nvidia which are typically used to capture short-term returns. Investors can double their gains (or losses) on Nvidia’s daily return during big news events like earnings,” Roxana Islam, VettaFi’s head of sector and business analysis informed FOX Trade.

| Ticker | Safety | Endmost | Alternate | Alternate % |

|---|---|---|---|---|

| NVDX | ETF OPPORTUNITIES TR T REX 2X LONG NVIDIA DAILY | 19.15 | -0.72 | -3.62% |

| NVDL | GRANITESHARES ETF TRUST 2X LONG NVDA DAILY ETF | 78.97 | -2.93 | -3.58% |

| NVDU | DIREXION DAILY NVDA BULL 2X SHARES | 127.56 | -4.71 | -3.56% |

With Nvidia stocks up over 200%, the stakes are prime for Wednesday’s effects. Income consistent with percentage are anticipated to leap just about 90% to 75 cents, day earnings is detectable emerging 83% to $33.16 billion.

Ed Egilinsky, managing director at Direxion, informed FOX Trade that his ETFs are for nimble buyers, fat and miniature, akin to NVDU.

| Ticker | Safety | Endmost | Alternate | Alternate % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 144.32 | -2.69 | -1.83% |

“It is providing two times the return of the Nvidia common stock for a given single day,” he mentioned. “The leverage could work for you if something is continually stair-stepping in your direction, no pun intended. But these vehicles were designed as short-term trading vehicles for active traders and should be monitored daily. You can’t just look at it and say ‘forget it’ even though Nvidia has done exceedingly well. But most stocks don’t trend up consistently higher and up to the magnitude Nvidia is,” he mentioned.

BITCOIN WHALE ETF HITS NEW HIGHS

Semiconductor chip put in on a circuit board on this image taken Feb. 25, 2022. (REUTERS/Florence Lo/Representation / Reuters)

Must Nvidia disappoint Wall Side road, alternative ETFs can also be old to play games the disadvantage.

“We also have the non-leverage inverse short. So that would be just the opposite of what invidious does on a single day basis for a given single day. So if Nvidia’s down 5% tomorrow, let’s say we have a vehicle that would make 5%, and that’s NVDD,” Egilinsky added.

| Ticker | Safety | Endmost | Alternate | Alternate % |

|---|---|---|---|---|

| SOXL | DIREXION SHARES ETF TRUST DAILY SEMICONDUCTOR BULL 3X | 26.21 | -1.61 | -5.80% |

| SOXS | DIREXION SHARES ETF TRUST DIREXION DAILY SEMICONDUCTO | 25.33 | +1.36 | +5.67% |

With a marketplace cap north of $3.5 trillion, Nvidia’s sway over all the marketplace and semiconductor sector is essential. Traders taking a look to seize a exit up or ill in a basket of semiconductor shares may just play games Direxion’s Day-to-day Semiconductor Bull and Endure 3X Stocks SOXL or SOXS, Egilinsky famous.

The corporate may be anticipated to forecast earnings between $39 billion and $40 billion for the tide quarter, which is able to come with the tech gigantic’s Blackwell Chips.

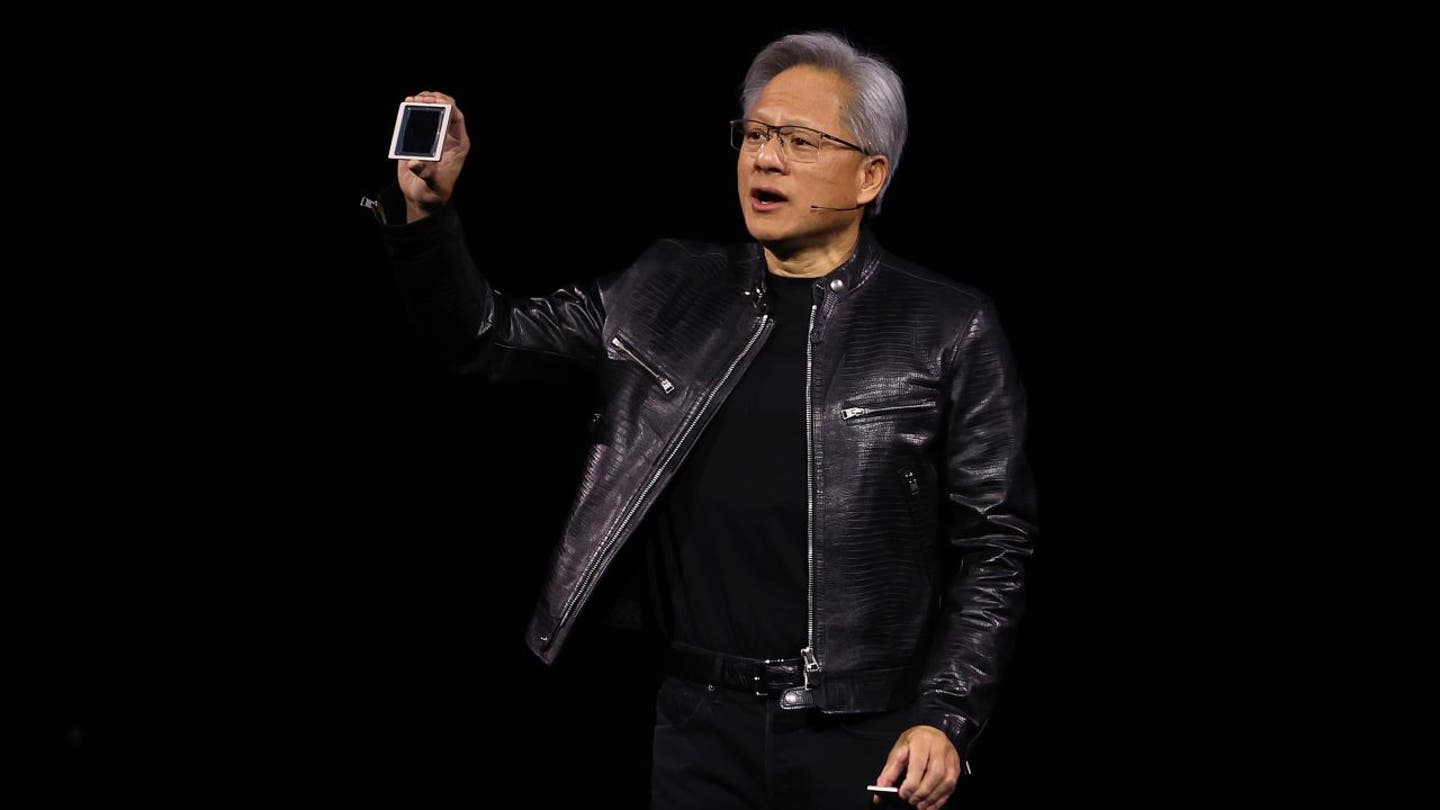

Nvidia CEO Jensen Huang delivers a keynote cope with all over the Nvidia GTC Synthetic Prudence Convention at SAP Middle on March 18, 2024, in San Jose, California. (Picture through Justin Sullivan/Getty Pictures / Getty Pictures)

Nvidia Well-known Monetary Officer Colette Kress informed buyers all over endmost quarter’s profits name in regards to the expectancies for those sooner processing chips.

“Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26. In Q4, we expect to get several billion dollars in Blackwell revenue,” Kress mentioned.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia CEO Jensen Huang will sit down ill with FOX Trade’ Liz Claman on “The Claman Countdown” at 3 p.m. ET on Thursday.