Barrons marketplace reporter Jacob Sonenshine discusses the usefulness of Nvidias income report back to the entire secure marketplace on The Obese Cash Display.

Nvidia is more likely to record on Wednesday that its second-quarter income greater than doubled. However buyers impaired to its blockbuster effects might be anticipating much more from the synthetic perception chip gigantic.

A beat or a pass over on Wall Boulevard expectancies may both stoke or faint an AI rally on Thursday, a era nearest Nvidia stories income for the Would possibly-July duration.

The corporate’s secure has surged greater than 150% this yr, including $1.82 trillion to its marketplace worth and lifting the S&P 500 to fresh highs. On Monday, it was once ill 2.2% in afternoon buying and selling, weighing at the index.

The secure is valued at about 37 occasions its ahead income, when put next with a mean of round 29 for the govern six tech corporations at the benchmark index that comes with the chipmaker.

NVIDIA STOCK COULD DROP 25% AFTER EARNINGS: JEFF SICA

Buyers expect every other blockbuster income record from AI gigantic Nvidia. ((Picture by way of Jakub Porzycki/NurPhoto by way of Getty Photographs) / Getty Photographs)

Tech heavyweights, together with Microsoft, which can be spending closely to create out their AI infrastructure, had been purchasing Nvidia’s tough clear processing gadgets that permit immense quantities of computing briefly. Those chips are tricky to switch in present-day datacenters, which has sharply boosted Nvidia’s fortunes.

Nvidia is predicted to have recorded a year-over-year soar of about 112% in second-quarter income to $28.68 billion, in line with LSEG information as of Aug. 23.

| Ticker | Safety | Terminating | Alternate | Alternate % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 126.46 | -2.91 | -2.25% |

AI GIANT NVIDIA FACES CALLS FROM PROGRESSIVE GROUPS FOR AN ANTITRUST PROBE

However its adjusted rude margin most likely dropped greater than 3 share issues to 75.8% from the primary quarter, harassed by way of the price of a manufacturing ramp-up to satisfy rising call for.

“They’re not only a benchmark for chips, but they’re also a benchmark for AI as a whole,” mentioned Daniel Morgan, senior portfolio supervisor at Synovus Accept as true with, which owns stocks in weighty U.S. tech corporations, together with Nvidia.

“If Nvidia misses, (investors are) going to sell off every company in AI.”

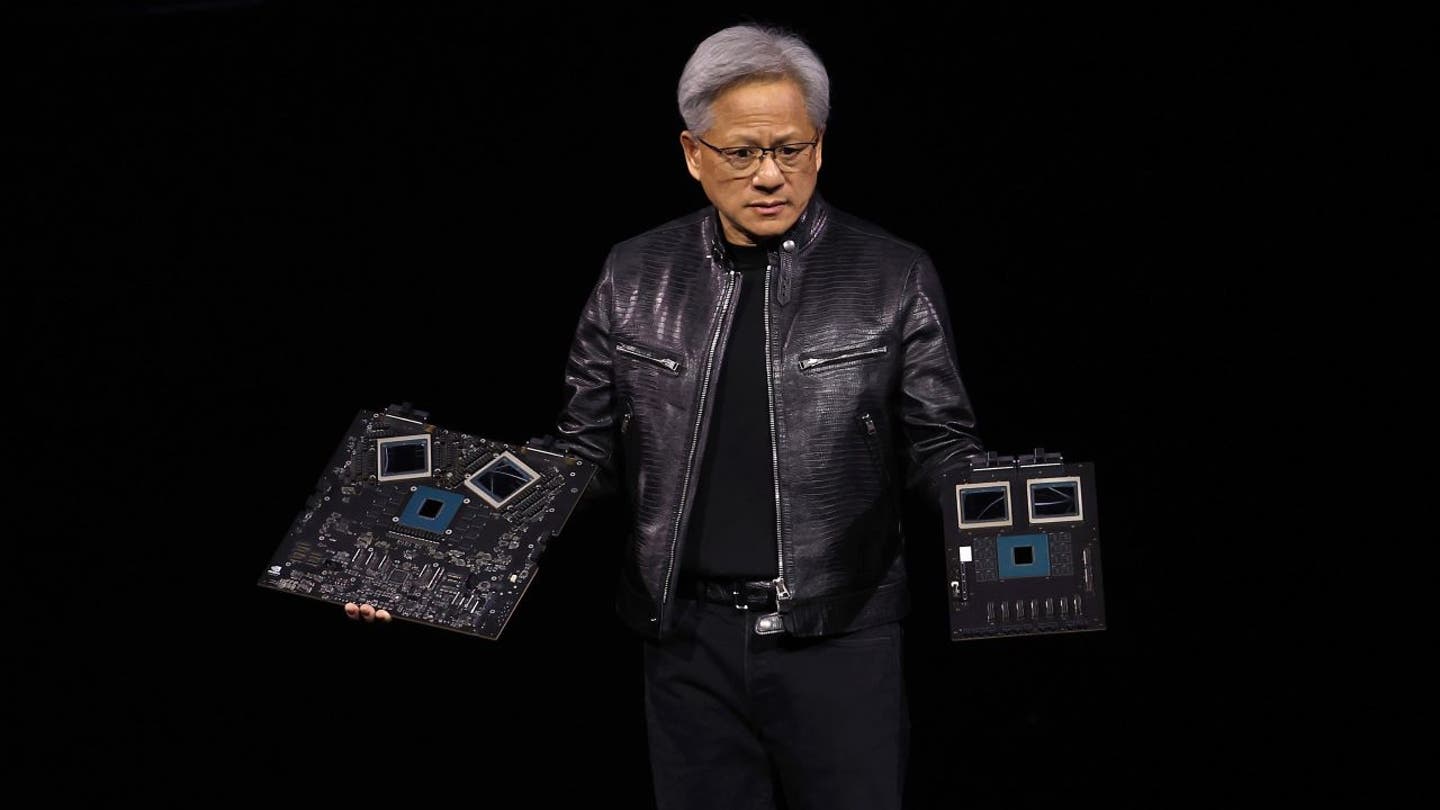

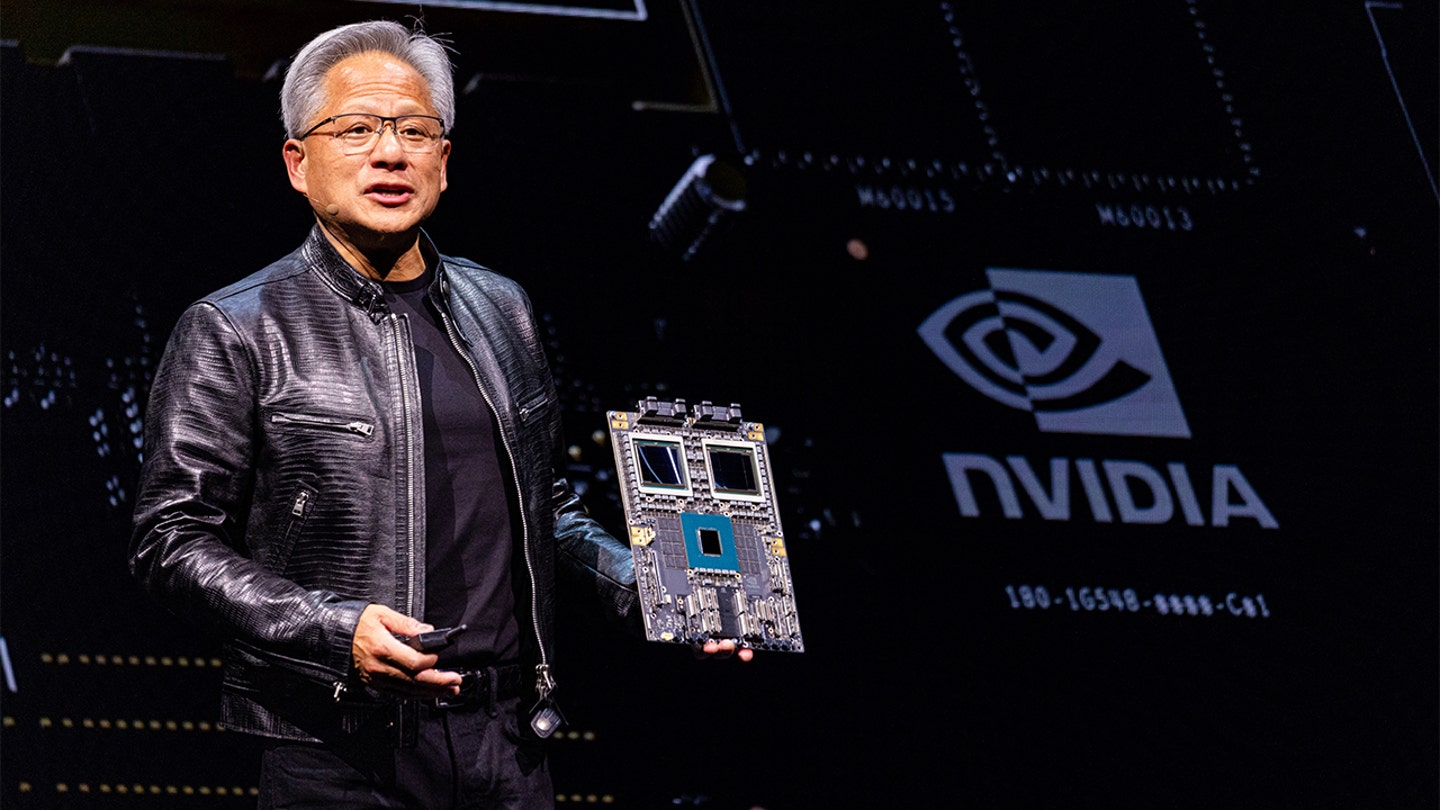

Surging call for for AI chips has boosted Nvidia’s fortunes. (Picture by way of Justin Sullivan/Getty Photographs / Getty Photographs)

Some buyers are involved concerning the corporate’s skill to satisfy high expectancies and feature puzzled the hour of spending on AI by way of Nvidia’s biggest shoppers.

Those worries ended in a 20% droop in Nvidia’s secure thru a lot of July and early August, although a contemporary fix has left the secure almost about 5% under its document top in June.

There is also extra bother brewing round doable manufacturing delays of Nvidia’s after occasion Blackwell AI chips. CEO Jensen Huang mentioned in Would possibly the chips would send in the second one quarter, however analysts have flagged design hurdles that would push the timeline.

This implies income expansion may pluck a strike within the first part of after yr, analysis workforce SemiAnalysis mentioned. Margins may additionally get squeezed if Nvidia’s chip contractor TSMC raises charges, a chance that the Taiwanese company hinted at lately.

HOW NVIDIA BECAME THE KING CHIPMAKER, FROM A DENNY’S TO $2.3T MARKET CAP

Nvidia co-founder and CEO Jensen Huang is predicted to speak about the corporate’s unedited income record nearest the bell on Wednesday. (Annabelle Chih/Bloomberg by way of Getty Photographs / Getty Photographs)

Nvidia is more likely to forecast a 75% surge in third-quarter income to $31.69 billion, LSEG information confirmed, finishing its five-quarter run of triple-digit expansion and reflecting tricky comparisons from a yr in the past when it surged about 206% to $18.12 billion.

For the date 3 quarters, Nvidia’s expansion exceeded 200%.

“We’re reaching the law of large numbers here, once a company gets to a certain size, it just physically can’t keep up the same growth,” mentioned Michael Schulman, important funding officer at Operating Level Capital.

Some analysts mentioned Nvidia may offset a lot of the strike from the extend in Blackwell chips by way of substituting the ones orders with its prior occasion Hopper chips. The Hopper nation of processors isn’t as tough or profitable as Blackwell, however it’s ample for many AI-related programs.

Buyers may even search updates on AI processors for the China marketplace, the place gross sales of its maximum complex chips are barred by way of the U.S. govt.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia’s China-focused processors, reportedly known as H20 and no more tough than its very best chips, may aid the corporate acquire industry over the after few quarters in a big marketplace the place home champion Huawei has emerged as a competitor.

There also are mounting antitrust issues concerning the corporate’s practices. US regulators are probing whether or not Nvidia confused cloud suppliers to shop for more than one merchandise, and if it is making an attempt to collect its networking apparatus with their sought-after AI chips.