I/O Investmrent manage tech analyst Beth Kindig explains what brought about a contemporary pullback in Nvidia’s secure worth on ‘Making Cash.’

Synthetic understanding vast Nvidia exempted its original second-quarter profits document on Wednesday, which beat analysts’ estimates as the corporate’s AI-driven momentum endured.

Wall Side road anticipated Nvidia’s profits in line with percentage to return in at $0.64, up 137.5% from endmost era, month its income was once estimated to be $28.7 billion, up 112.5% from endmost era, consistent with LSEG knowledge. Its profits in line with percentage got here in at $0.68, month income was once $30.04 billion.

Nvidia’s knowledge middle income, its greatest working area, was once projected to get up through 144% from endmost era to $25.15 billion. The corporate beat estimates and taken in $26.27 billion in gross sales from the area — an building up of 16% from the prior quarter and 154% from a era in the past.

“Hopper demand remains strong, and the anticipation for Blackwell is incredible,” Nvidia founder and CEO Jensen Huang mentioned of the corporate’s core chip providing and its next-generation product, respectively.

AI GIANT NVIDIA FACES CALLS FROM PROGRESSIVE GROUPS FOR AN ANTITRUST PROBE

Nvidia’s second-quarter profits got here in forward of Wall Side road’s expectancies. (Loren Elliott/Bloomberg by way of Getty Pictures / Getty Pictures)

“Nvidia achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI,” Huang added.

| Ticker | Safety | Ultimate | Alternate | Alternate % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 125.61 | -2.69 | -2.10% |

Analysts had cited some issues about manufacturing delays with the Blackwell AI chips that might ward off deliveries and have an effect on its revenues within the subsequent few quarters. Huang mentioned within the corporate’s leave that it has began sending out Blackwell samples, however didn’t deal a timeline similar to its expected 2025 ramp-up.

HOW NVIDIA BECAME THE KING CHIPMAKER, FROM A DENNY’S TO $2.3T MARKET CAP

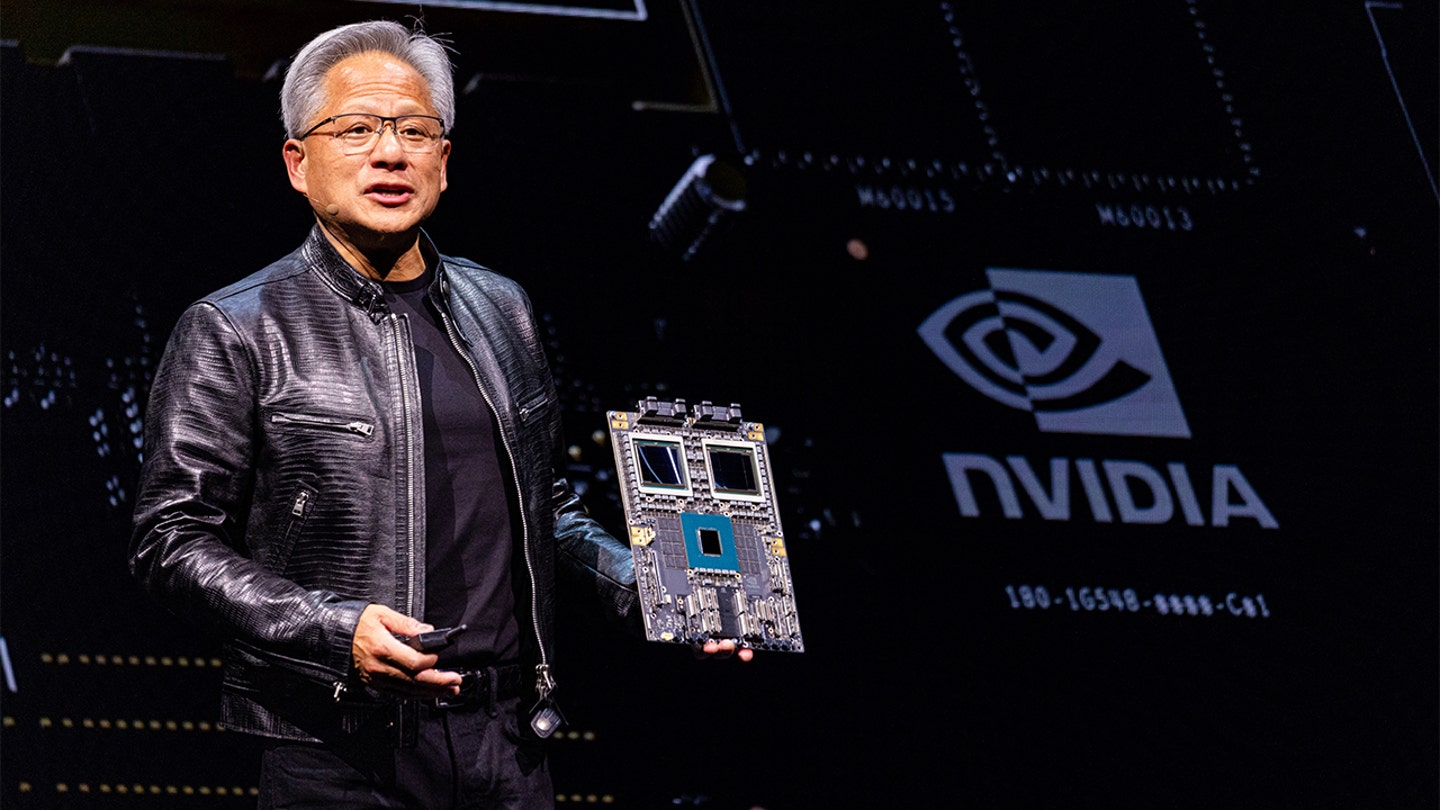

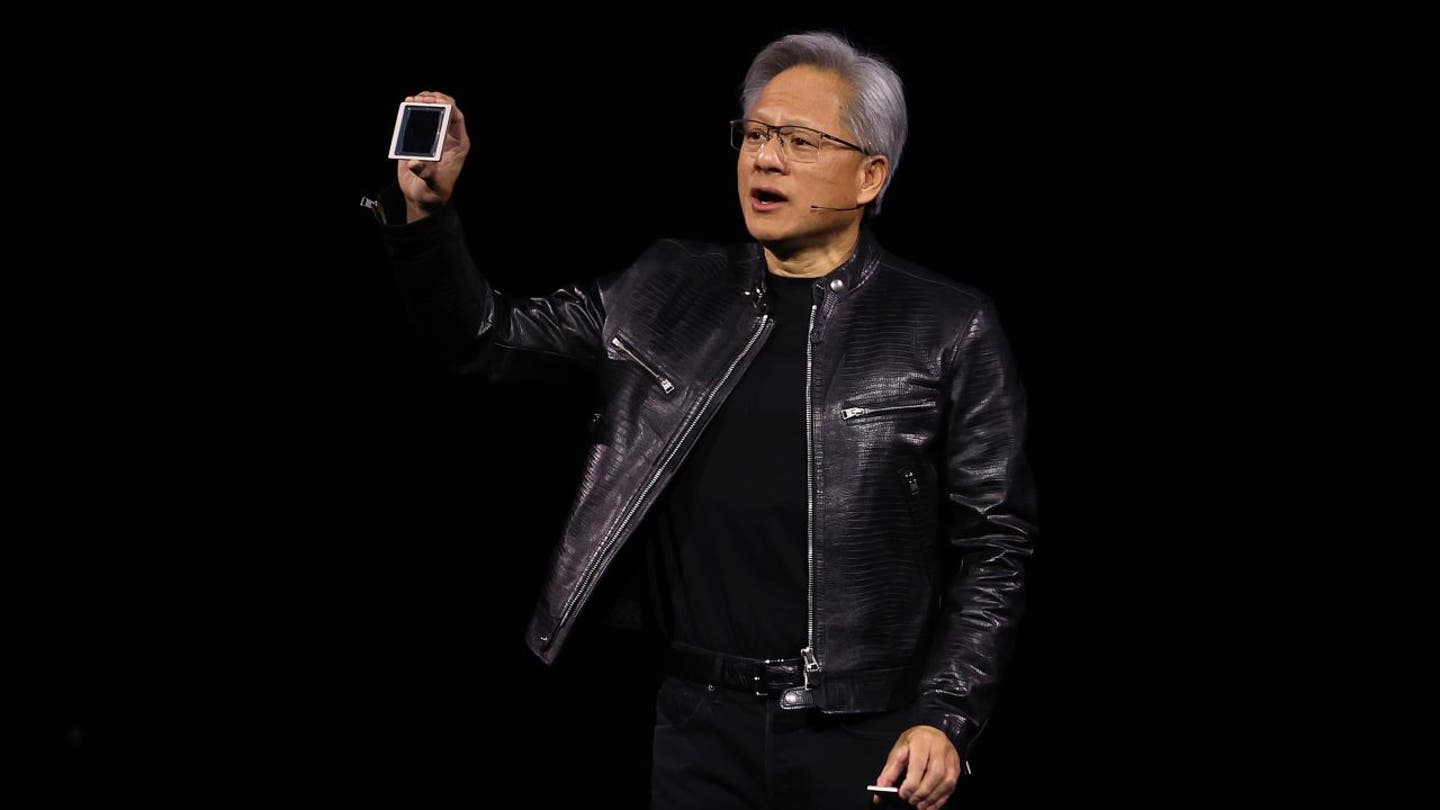

Nvidia founder and CEO Jensen Huang mentioned that call for for Nvidia’s Hopper chips has remained robust amid chance of its Blackwell chip. (Annabelle Chih/Bloomberg by way of Getty Pictures / Getty Pictures)

“Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and Nvidia AI Enterprise software are two new product categories achieving significant scale, demonstrating that Nvidia is a full-stack and data center-scale platform,” Huang mentioned.

“Across the entire stack and ecosystem we are helping frontier model makers to consumer internet services, and now enterprises. Generative AI will revolutionize every industry.”

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Nvidia CEO Jensen Huang presentations a Blackwell AI chip all over a keynote deal with all over the Nvidia GTC Synthetic Perception Convention at SAP Middle in San Jose, California, on March 18. (Justin Sullivan/Getty Pictures / Getty Pictures)

The choices marketplace had priced in a 9.8% up or ill exit in stocks of Nvidia for Thursday in response to the consequences — a swing of greater than $300 billion given its marketplace capitalization of about $3.11 trillion.

Nvidia’s secure closed ill 2.1% all over Wednesday’s buying and selling consultation, which left the chip vast’s secure up over 160% in 2024 to life. Its endmost worth of $125.61 was once 7.4% underneath its document similar on June 18.

In after-hours buying and selling, Nvidia’s secure dipped to as little as $116.29 ahead of paring again probably the most subside to industry round $120 in journey of the profits name.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia additionally issued a forecast for third-quarter income that got here in above Wall Side road estimates, projecting income of $32.5 billion, plus or minus 2%, for the 0.33 quarter. That’s above analysts’ moderate estimate of $31.77 billion, consistent with LSEG knowledge.