BlackRock chairman and CEO Larry Fink offers his tackle tariff negotiations with China and marketplace volatility on ‘The Claman Countdown.’

U.S. monetary markets wrapped up one in every of their maximum risky weeks because the COVID-19 pandemic as President Donald Trump performs rapid and enraged together with his tariff plan that caused retaliation from China.

When the mud settled, all 3 of the main benchmarks recorded beneficial properties on Friday, which added to the weekly progress.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 40212.71 | +619.05 | +1.56% |

| SP500 | S&P 500 | 5363.36 | +95.31 | +1.81% |

| I:COMP | NASDAQ COMPOSITE INDEX | 16724.45559 | +337.14 | +2.06% |

The Dow Jones Commercial Reasonable received 5% for the generation, the S&P 500 just about 6% and the Nasdaq Composite 7%.

Nonetheless, the 3 primary indexes stay unfavourable for the 12 months.

VOLUME AND VOLATILITY

The general numbers didn’t come with out nail-biting. The CBOE’s Volatility Index, often referred to as Wall Side road’s worry gauge, clash a five-year top because the Dow noticed swings of greater than 2,000 issues all through a number of periods.

CBOE’s Volatility Index (Courtesy: Google )

AMID STOCK SELL-OFFS, DON’T PANIC, EXPERTS SAY

The Dow received 2,692 issues on Wednesday, the most important one-day level be on one?s feet in historical past. General buying and selling quantity in this past neared $30 trillion, the absolute best since a minimum of Would possibly 2019, as tracked by means of Dow Jones Marketplace Information Staff. This is identical past that Trump, in a awe pivot, paused price lists on some nations.

Dow Jones Commercial Reasonable

.

BlackRock CEO Larry Fink famous the marketplace’s resiliency on a convention name with buyers Friday, and mentioned he extra positive about capital markets.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 878.97 | +21.82 | +2.55% |

“We do not see systemic risks that there is not a pandemic,” Fink mentioned. “The financial system is shown safe and sound, and the resiliency. The markets are trading more, more volume with the liquidity than any other time. With all this volatility, the markets have proven to be quite successful and work quite well. “Clearly, there’s near-term confusion.”

TARIFF PROGRESS

While uncertainty around tariffs tested investor resolve, the White House insists deals are being hammered out by U.S. Trade Representative Jamieson Greer.

“He showed that greater than 15 offer are already at the desk, which is important in only a mere subject of days. And, as I mentioned previous, we’ve heard from greater than 75 nations world wide,” White House press secretary Karoline Leavitt said on Friday.

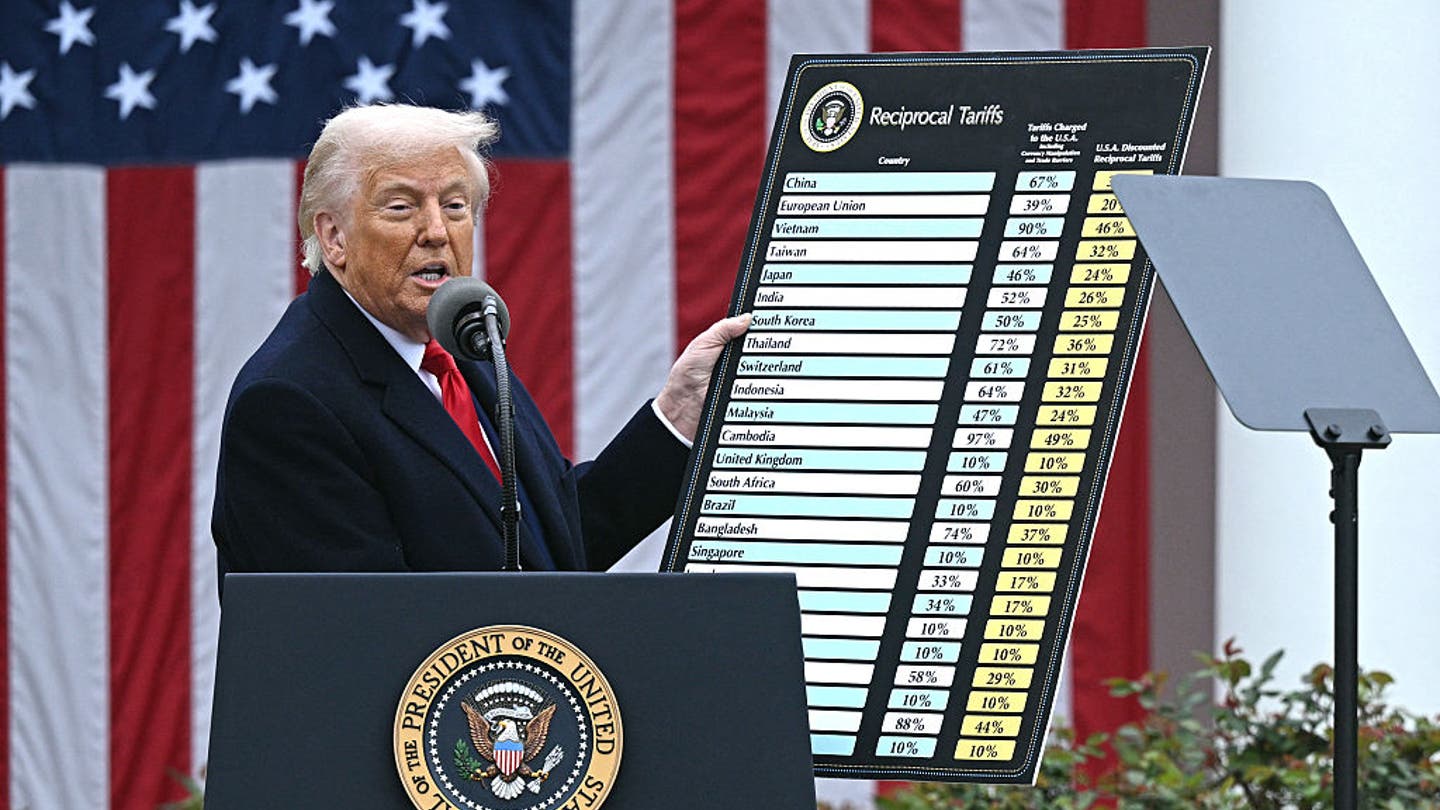

President Donald Trump holds a chart as he delivers remarks on reciprocal tariffs during an event in the Rose Garden entitled “Form The usa Rich Once more” at the White House in Washington, D.C., on April 2, 2025. (BRENDAN SMIALOWSKI/AFP via Getty Images))

BOND MARKET: 10-year Treasury Yield 4.5%

Government bonds are flashing a more troubling signal as investors pull money out over concerns of a looming recession. When yields rise, prices fall. The 10-year Treasury, the benchmark for borrowing costs such as mortgages and personal loans, hit 4.5%, the highest since February. The weekly 50-plus basis point jump was the biggest in over 40 years.

Treasury Secretary Scott Bessent was asked about this trend on Wednesday.

“There’s some very immense, leveraged avid gamers who’re experiencing losses which might be having to do leverage,” he told Maria Bartiromo during an interview on “Mornings With Maria.” “I consider that there’s not anything systemic about this. I believe that it’s an uncomfortable however commonplace deleveraging that’s occurring within the bond marketplace.”

BIG BANKS CEOS WEIGH IN ON TRUMP’S TARIFFS: ‘CONSIDERABLE TURBULENCE’

Bessent was also asked about the weakening U.S. dollar and actions by the Chinese.

“They’ve in reality been weakening their forex, which is a loser for everybody. And once more, once I pay attention a lot of these tales that the buck is now not committing to be the keep forex, if you find yourself with the Chinese language who’re prepared to usefulness their forex as a business instrument, that doesn’t appear to be an excellent keep asset to me,” Bessent said.

The euro and the Japanese yen are up 8% vs. the greenback.

U.S. RECESSION?

A handful of Wall Street firms are dialing up odds that a U.S. recession is possible. JPMorgan Chase CEO Jamie Dimon shared his view this week.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 236.13 | +9.39 | +4.14% |

“I hear it from just everybody now. ‘I’m going to cut back a little bit, I’m gonna wait, see what happens.’ That is kind of recessionary talk,” Dimon mentioned Wednesday in an unique interview on “Mornings with Maria.” When requested if he’s in my view anticipating a recession, Dimon replied: “I am going to defer to my economists at this point, but I think probably that’s a likely outcome.”

His company ratcheted up recession odds to 60%, month Goldman Sachs now sees a forty five% probability of 1 hitting The usa.

CONSUMER FEARS

The College of Michigan’s Surveys of Customers on Friday reported that its Client Sentiment Index dropped to 50.8 this life from 57 in April, the fourth directly per thirty days reduce.

“This decline was pervasive and unanimous across age, income, education, geographic region and political affiliation,” mentioned Surveys of Customers Director Joanne Hsu.

Client sentiment plunged in April. (Photographer: Patrick T. Fallon/Bloomberg by way of Getty Photographs / Getty Photographs)

RECESSION FEARS, TARIFF UNCERTAINTY PROMPT PLUNGE IN CONSUMER SENTIMENT

“Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year. Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month,” Hsu added.

INFLATION

The patron worth index for March dropped 0.1% vs. February however remained up 2.4% yearly, nonetheless above the Federal Hold’s 2% mandate.

Moment prices are easing, costs for pieces comparable to eggs and raw farmland red meat stay increased, up 60% and 10%, respectively.

GOLD SAFE HAVEN

The dear steel noticed some volatility this generation however rebounded to an all-time top of $3,222.20 an oz.. The 7% weekly acquire used to be the most important since March 2020. Even sooner than the tariff wars escalated, a number of strategists conveyed bullish perspectives at the yellow steel, additionally an inflation hedge and a conventional defend haven.

Gold rebounded to an all-time top of $3,222.20 an oz. this generation. (Photograph by means of ARNE DEDERT/dpa/AFP by way of Getty Photographs / Getty Photographs)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“While traditionally inflation and real yields have been the main drivers of gold prices, recently central bank buying has emerged as the primary catalyst behind the current gold price increase,” in line with an early April analysis word by means of Warehouse of The usa’s World Commodity Analysis’s Franciso Lighten and Irina Shaorshadze. The workforce sees gold achieving $3,500.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST – USD ACC | 297.93 | +5.62 | +1.92% |

BITCOIN

The biggest cryptocurrency by means of marketplace worth rose Friday, soaring simply above $83,000. Nonetheless, its indisposed 21% from its all-time top of $106,734.51 reached in December 2024.